The Rise of Q-Commerce in India: Transforming Retail at Lightning Speed

-

What is Q-commerce?

Imagine a day in the life of a tech-savvy freelancer in Hyderabad. He’s managing tight deadlines, frequent client calls, and the demands of working from home in a fast-paced city. As the afternoon passes, he realizes he’s out of coffee—his fuel for late-night work sessions—but there’s no time for running to a store. Or consider a busy architect in Pune who, after wrapping up a site visit, needs to restock her kitchen for a dinner party quickly. In such situations, quick commerce is revolutionizing how people meet their everyday needs, delivering essentials right when they’re needed most in a blink.

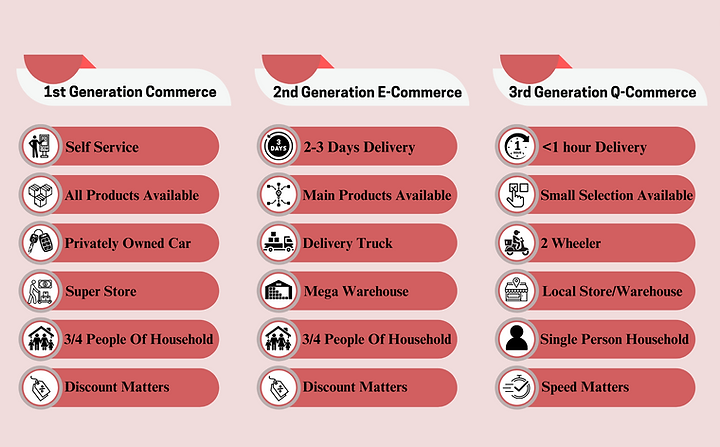

Quick commerce, or "q-commerce," focuses on ultra-fast delivery, typically within 10 to 20 minutes. This model thrives in urban areas, driven by the need for convenience and instant access to essentials. Unlike traditional e-commerce with longer delivery times, q-commerce relies on hyper-local "dark stores" and efficient logistics to quickly deliver groceries, daily necessities, and fast-moving consumer goods (FMCG).

2. Understanding the future of Ultra-Fast Delivery

One development that has dramatically changed the retail and e-commerce market is the explosive growth of q-commerce in India. With a $3.34 billion market currently, e-commerce is positioned to become a disruptive trend and change the retail landscape in the time ahead.

India's quick commerce sector is predicted to grow rapidly by 2025, reaching an estimated $5.8 billion. This market is expected to expand at a compound annual growth rate (CAGR) of 24.33% and reach a projected volume of US$10 billion by 2029.

India's $43 billion addressable market for fast commerce is being driven by mid to high-income urban families. The number of Quick Commerce users in India is predicted to reach 60.6 million by 2029, indicating a strong expansion of the market. By 2029, it is projected that the 1.8% user penetration rate in 2024 will rise to 4.0%. It is also anticipated that the average revenue per user (ARPU) will be roughly US$127.70.

This trend is particularly evident in metro cities like Delhi, Mumbai, and Bangalore, where busy professionals and young consumers are the primary drivers of demand.

3. Key Players Leading the Q-Commerce Revolution in India

The q-commerce market in India is dominated by several key players, including Blinkit (formerly Grofers), Swiggy Instamart, Zepto, and Dunzo. Each of these companies has carved out a niche by offering unique value propositions to consumers.

Blinkit (Zomato): Leading the market with a 40% share, Blinkit, formerly Grofers, excels in delivering groceries within 10 minutes through a vast network of micro-warehouses in urban areas.

Swiggy Instamart: Now holding 30% of the market, Swiggy Instamart has seen its lead diminish due to competition from Blinkit and Zepto. It offers delivery within 15-30 minutes.

Zepto: Rapidly growing with a 25% market share, Zepto focuses on ultra-fast 10-minute deliveries driven by advanced tech for optimized routes and inventory.

Dunzo: A smaller player in the market, Dunzo leverages local store partnerships for quick deliveries but holds a minimal market share compared to the top players.

4. Consumer Behavior Driving Q-Commerce Demand in Urban India

Urbanization and Lifestyle Changes:

India's rapid urbanization has fueled the rise of q-commerce, driven by the growing demand for convenience and time-saving services. Urban consumers, particularly millennials and Gen Z, increasingly rely on q-commerce for essentials like groceries and quick snacks. Research shows that over 60% of urban Indian consumers prefer shopping for groceries multiple times a week rather than in bulk, heightening the demand for fast delivery. While q-commerce currently dominates in large cities, Tier 2 and Tier 3 cities are expected to contribute 30-35% of growth by 2026.

Shift Towards Online Shopping:

The COVID-19 pandemic rapidly accelerated online shopping in India, boosting digital buyers to 330 million by 2022, a significant rise from pre-pandemic levels. This surge, driven by lockdowns and safety concerns, led to e-commerce growth of 25-30% annually. Capitalizing on this trend, q-commerce offered a faster alternative, growing 150% in 2023 and reaching 20 million monthly active users.

Personalization and Customer Experience:

By 2023, over 80% of q-commerce platforms in India were utilizing AI and machine learning to enhance personalization, predict consumer needs, and optimize inventory. This focus on personalization drove customer retention, with 70% of users preferring personalized experiences, leading to stronger loyalty. Additionally, AI-driven insights reduced inventory costs by 15-20% and improved delivery times by 25%, boosting overall customer satisfaction.

4. Technological Advancements Driving Q-Commerce

AI and Machine Learning:

AI and machine learning are integral to the q-commerce revolution. These technologies allow companies to forecast demand accurately, manage inventory efficiently, and optimize delivery routes. AI-driven demand forecasting has reduced stockouts by 15-20% and improved delivery efficiency.

Supply Chain and Logistics Optimization:

Q-commerce relies heavily on a well-optimized supply chain and logistics network. Companies are investing in state-of-the-art technology to streamline operations, from order processing to last-mile delivery. This includes the use of automated warehouses, robotic picking systems, and real-time tracking to ensure that products are delivered quickly and efficiently.

Mobile and Digital Payments:

With over 760 million smartphone users and the proliferation of digital payment systems like UPI, consumers can easily browse, order, and pay for products in seconds, fueling the growth of q-commerce

5. Is Quick Commerce a High Investment Category?

Growth and Scalability:

Q-commerce addresses the evolving consumer habit of frequent, smaller purchases instead of bulk buying. This segment, which was valued at $0.3 billion in 2022, is expected to reach $5.5 billion by 2025, indicating its potential for expansion, especially in urban areas.

Market Dynamics:

-

Quick commerce is a high-investment sector with significant operational costs. Despite scaling, companies like Zomato still face financial challenges in this space.

-

Achieving profitability in quick commerce requires sophisticated analytics for optimal placement of dark stores and efficient management of investments.

Expansion Opportunities:

-

Quick commerce could extend beyond groceries to other categories like electronics and office supplies. The speed of delivery is a key differentiator, and expanding into these areas could offer competitive advantages.

Impact on General Trade:

-

General stores, traditionally known for quick service, could adapt to compete with quick commerce players by leveraging similar operational models, though they might not match the sophistication of dedicated quick commerce platforms.

Digital Integration for Retailers:

-

For established retailers like D-Mart, integrating digital strategies with physical stores is essential. This involves using digital technologies to complement traditional retail operations and meet customer expectations.

India's $60-65 billion e-commerce market, overshadowed by China's, is facing disruption from quick commerce, which is rapidly gaining traction by adopting the Kirana store model for swift deliveries. Blinkit, with a 40% market share, now holds a higher valuation than its parent company, Zomato, and Zepto has recently achieved unicorn status. The $500 billion grocery market is the main focus, particularly among millennials, with 60% of users aged 18-25 favoring quick commerce. However, challenges in scaling to smaller cities and competition from giants like Flipkart remain significant.

Conclusion:

As India's quick commerce market evolves, it's clear that this sector represents a significant shift in consumer habits. The rapid growth, heavy investments, and expanding user base highlight its vast potential. Yet, with these opportunities come challenges that demand innovation, strategic planning, and deep consumer insight. Companies that effectively refine their models, leverage advanced technologies, and explore new markets will drive this industry forward, balancing speed, efficiency, and customer satisfaction in a highly competitive space